projects

ARRtistry

Jan 2020

There is wide variation in estimations of the total volume of art transactions, ranging from $70bn to $120bn annually. The huge gap between these estimated figures underlines a fundamental fact about the art market: much of it is hidden from public view.

Lacking a widely-adopted title registry, the art market is highly fragmented. This generates an environment where fraud and forgeries are rampant; artists more often than not don’t receive the royalties they’re legally owed, and data is hard to collect.

The problems stem from three issues:

- The inability to track provenance, that is, data about the sales, chain of ownership, and other significant events a piece of artwork has undergone.

- The bureaucracy and lack of incentives surrounding the reporting of the sales of pieces of artwork.

- A lack of trust between art market professionals in any centralized attempt at a registry.

ARRtistry provides a distributed registry that art market professionals can embrace as they don’t have to trust one central entity with their data: our system automatically develops tamper-evident, tamper-resistant public provenance trails.

To facilitate its function as a registry, ARRtistry also provides streamlined implementations of the financial products related to art sales: consignment, royalties, and the sales themselves.

Adopters of our system will have their bureaucratic load vastly reduced, all the while publicly demonstrating legal compliance. By providing a registry our system provides clear solutions to the issues posed by the art market’s fragmentation.

ARRtistry is the first fully distributed and transparent system of its kind, meaning it is the only one that stakeholders can trust. It is also the first to automatically distribute Artist’s Resale Rights when their pieces are sold. We calculate that ARRtistry will save art market professionals upwards of £40,000 and 1,500 man-hours annually 1, greatly incentivizing the reporting of sales on the platform. Codex, an existing art registry, charges $2 for what in our system costs 4p 2.

Under ARRtistry, forgeries can be detected and traced; collectors are guaranteed to have the value of their piece preserved via the provenance trail; art market professionals have less paperwork and can signal reputability; regulators have a market they can finally collect data on; and artists are paid more money, more often.

Simply put, ARRtistry engenders a fairer ecology for the art market.

Motivation

The Artist’s Resale Right (ARR) entitles creators […] to a royalty each time one of their works is resold through an auction house or art market professional.

In the UK there are over 500 galleries that do not respond to ARR queries, despite it being a legal requirement for them to do so, meaning many artists do not get the money they’re rightfully owed. Even for galleries and dealers that do comply, the current system is inefficient taking up to half an hour to complete.

As one gallery owner said, “feels like your VAT Return, except you have to do it 4 times”.

- Transfer: Art pieces should be transferable either:

- Directly from the artist.

- Through consignment to galleries and auction houses.

- Provenance: Art pieces should build up an auditable trail of ownership.

- Must include sale price / ARR.

- Should be able to hide sale price / ARR from the public.

- Should be able to be done retroactively (but flagged as so).

- Expedite ARR: The ARR payment process is easy to reduce administrative load and increase payment of ARR.

- Prevent fraud: Prevent fraudulent pieces from entering the art market by setting up robust governance.

Architecture

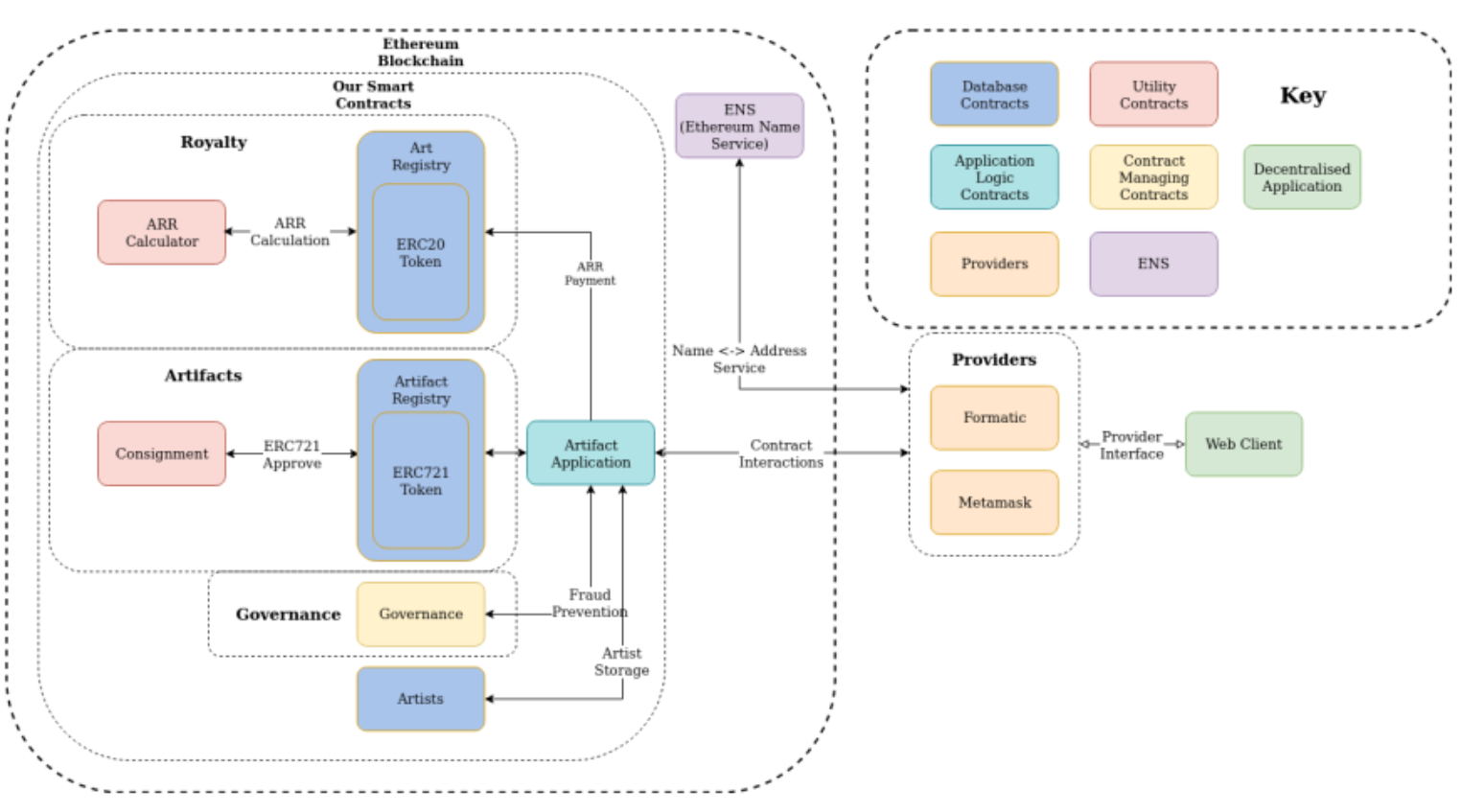

ARRtistry is a significant software project. It is comprised of over 10,000 lines of code, split across 21 Smart Contracts and 58 React components.

The main component is written on the Ethereum platform and can be treated as three isolated core modules (Artifacts, Governance, and Royalty) and two add-on modules (Artifact Application and Artists).

- Artifacts – Responsible for the digital representation of the art piece. Includes

ArtifactRegistryandConsignment. - Governance – Controls access to the registries, provides a service to check authorization, and performs some ACL management. Constitutes of the two contracts Governance and Moderated.

- Royalty – Distributes ARR payments, interfaces with digital value store (e.g. ERC-20 token corresponding to euros),

- Artifact Application – An example of the interoperability of the platform. It bundles commonly used sequences of commands (e.g. to register and approve a new digital representation)

- Artists – An opt-in user profile system.

Provenance

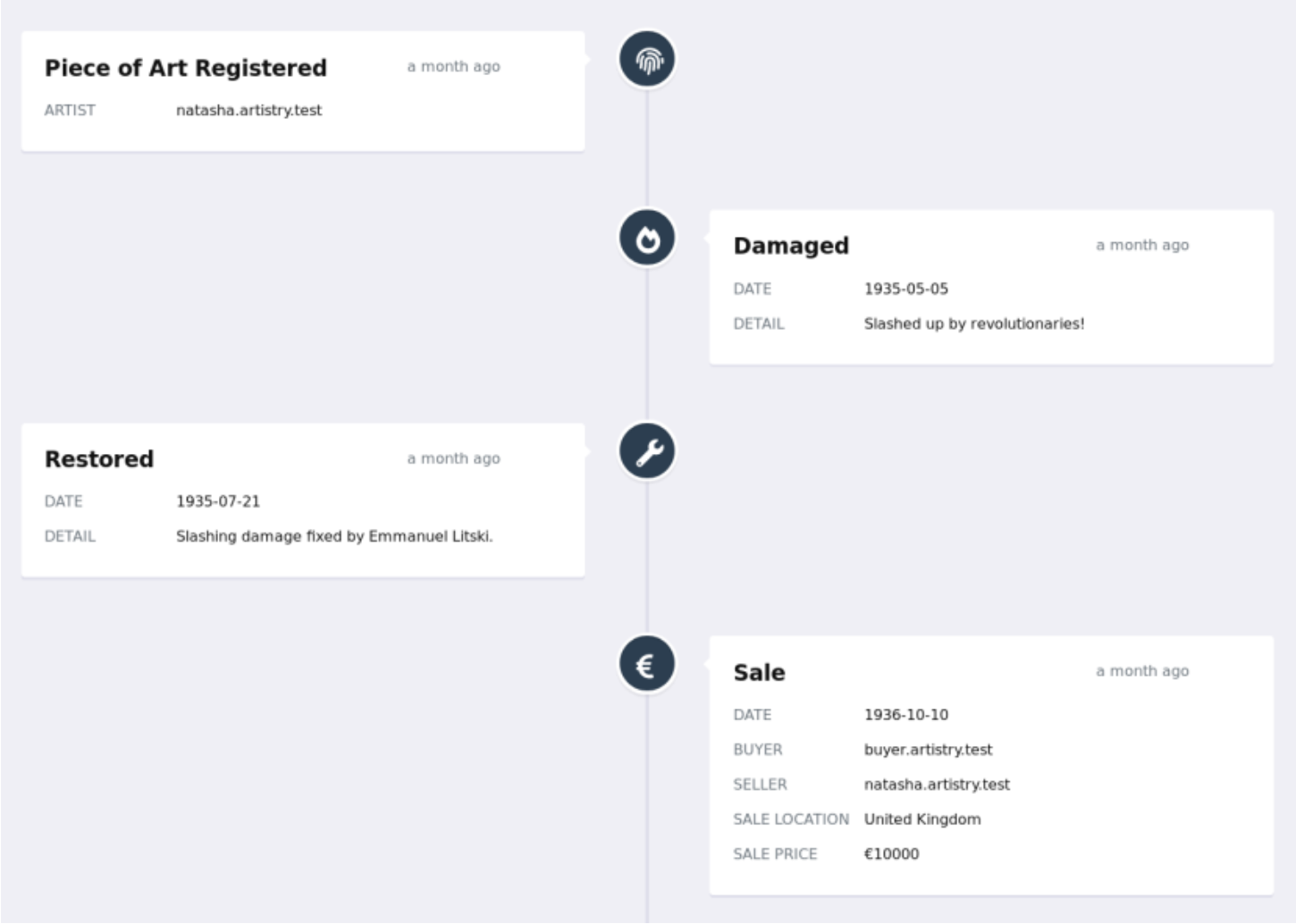

We use Solidity’s Events functionality for storing and getting provenance. We emit events at key points, representing the key points in an art piece’s life cycle. An event is a small bit of data stored permanently on the blockchain, searchable by the event’s name, and filterable by whichever fields in the event’s data we use as an index.

Example of a

Whenever artwork info is displayed in the UI – for example, in a user’s artifact page – the user can elect to see that piece’s provenance too. Each type of provenance is collated by trawling through events on the blockchain.

There are three types of provenance:

- Registration (aka Mint): This is found by looking for the Transfer event – the name is forced by our

use of ERC-721. We find all these events, then filter them by the from the field, looking for

Transfersfrom the0x0...0address. Only one event will ever match this. By looking at the to field on that event, we can see which artist/owner registered the piece (i.e. minted the token). - Sales: Whenever a sale happens, the contract emits a

RecordSaleevent, which stores: the wallets between whom the sale occurred, the price, the ID of the piece, the date, and the location. Furthermore, at this point we also update thesaleProvenancearray of strings in the art piece’s metadata, to include the new sale. Since a new metadata file is uploaded every single time, this gives us snapshots of the previous versions of a piece’s provenance, which could be useful if a malicious entity managed to alter it somehow. - Other Significant Events: Of course, many other things can happen to paintings. Several have been implemented. Their event names follow the format

Record<EventName>, e.g.RecordStolen. These events are all searched for and collated too.

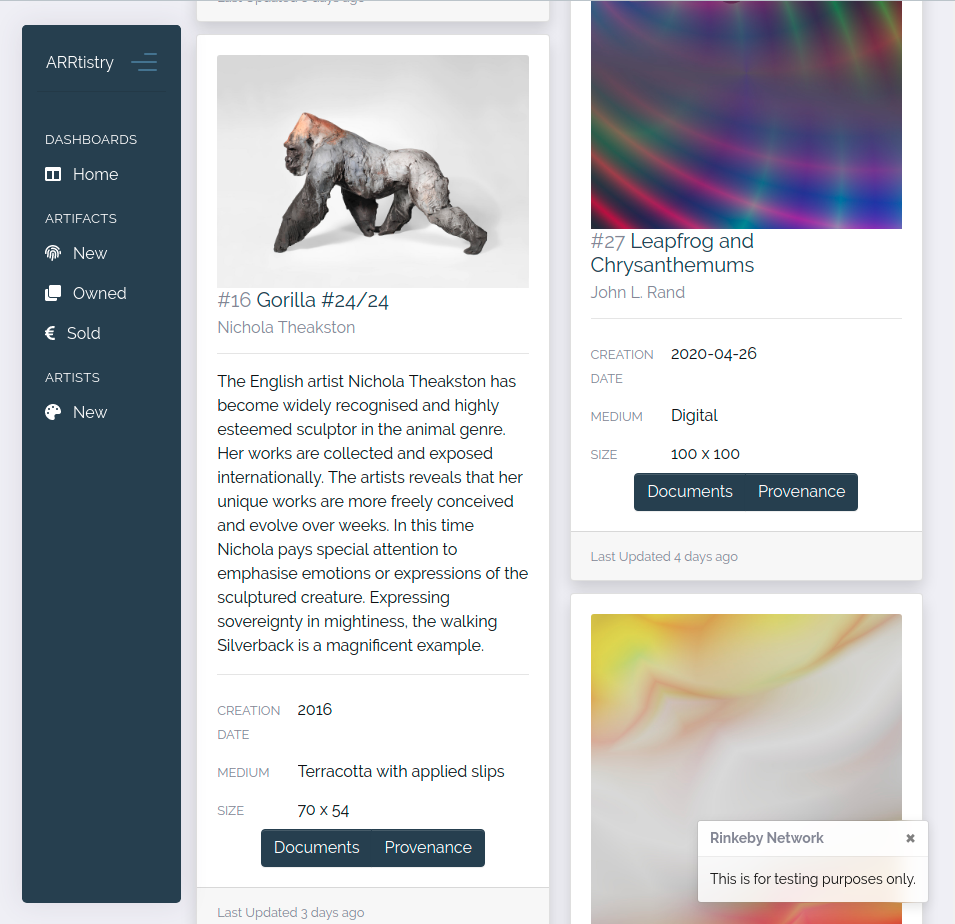

Example of a sculpture by Nichola Theakston tokenized and linked to the real-world asset.

Footnotes

-

The median time for the existing ARR payment process is at least 25 minutes per artwork (calculated by summing the time for determining whether a transaction qualifies for ARR, and completing the collecting society’s resale royalty). With ARRtistry, calculating whether a transaction qualifies for an ARR payment, and the collection and distribution of the ARR payment from and to the corresponding parties (i.e the entire ARR payment process) is automatically performed at the point of registering a sale of artwork on the platform. From observing 10 users registering a sale through our web interface we found that the median time they took was 4.8 minutes per artwork on their first attempt. If there are 4758 sales in a year (from page 10 of ‘A study into the effect on the UK art market of the introduction of the artist’s resale right’), then this saves about 1500 man-hours. ↩

-

The cost at the time of writing to register a piece was 160020 gwei or 0.0001602 ETH. ↩